Dwola (Dwolla) ACH Payment Platform: Full Business & Technical Overview

Introduction

Many users search for dwola when looking for ACH-based payment infrastructure. In most cases, this refers to Dwolla, a U.S. fintech company specializing in bank-to-bank transfers via the Automated Clearing House (ACH) network.

ACH payments are commonly chosen by SaaS platforms, marketplaces, and fintech apps seeking lower transaction costs and direct bank transfers. This guide provides a structured breakdown of Dwola’s capabilities, integration process, and business applications.

What Is Dwola?

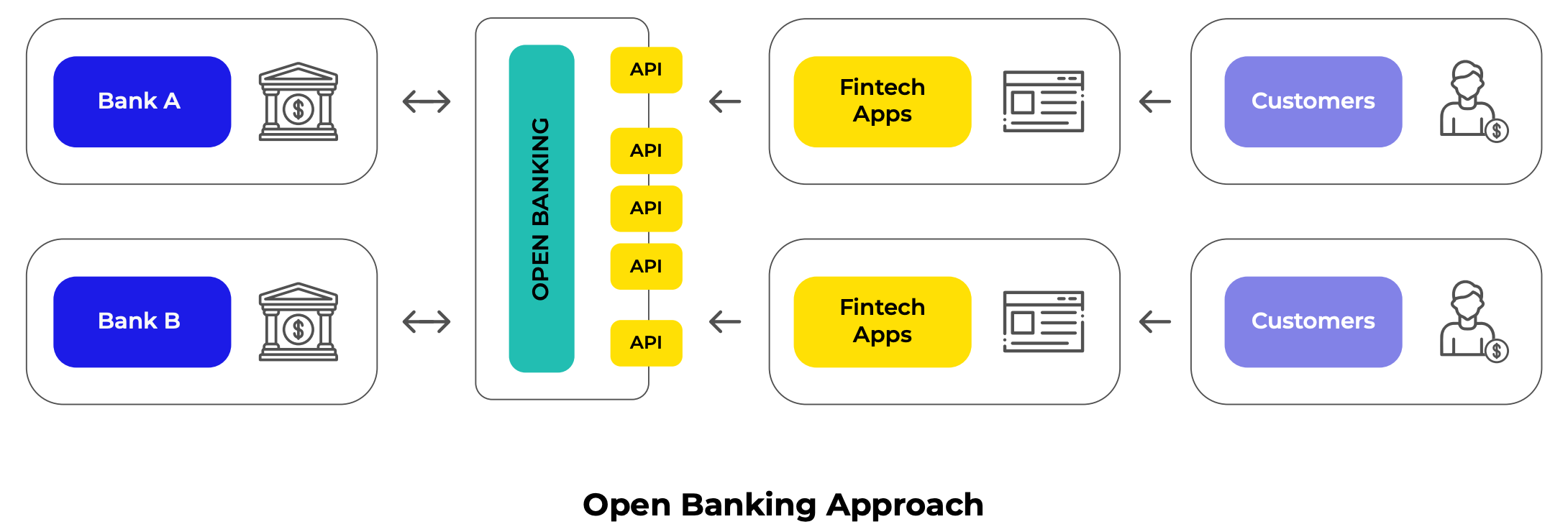

Dwolla provides API-driven ACH payment infrastructure. Instead of offering a consumer wallet or card processing system, Dwola enables businesses to embed secure bank transfer functionality directly into their applications.

Dwola is typically used for:

- ACH bank transfers

- Recurring subscription billing

- Marketplace settlements

- Account-to-account (A2A) payments

- Vendor and contractor payouts

Dwola System Architecture

4

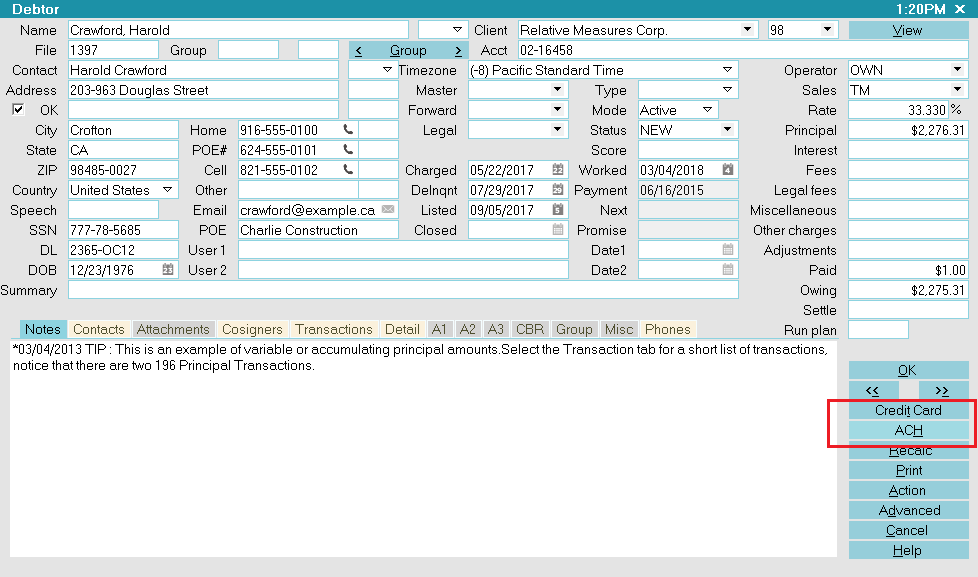

1. API Integration Layer

Dwola provides RESTful APIs allowing businesses to:

- Create customer entities

- Securely link bank accounts

- Initiate ACH transactions

- Monitor payment status

- Receive webhook event notifications

This API-first model enables seamless embedding within SaaS platforms and fintech applications.

2. Bank Account Verification

Verification workflows confirm account ownership and reduce the risk of transaction failures.

3. ACH Processing Through U.S. Banking Rails

Payments are processed via the U.S. ACH network, enabling direct transfers between financial institutions.

4. Reporting & Monitoring

Businesses can access:

- Transaction lifecycle updates

- ACH return notifications

- Exportable logs

- Automated webhook alerts

These tools support reconciliation and operational visibility.

Key Features of Dwola

ACH-Focused Payment Rail

Dwola specializes in ACH payments rather than card processing.

Embedded Payment Experience

Companies retain control of the front-end user experience and branding.

Automation & Webhooks

Real-time webhook notifications allow workflow synchronization across systems.

Compliance & Risk Controls

Identity verification and transaction monitoring tools are built into the platform.

Industry Applications

4

Dwola is frequently implemented by:

- Online marketplaces

- SaaS subscription platforms

- Fintech companies

- Businesses automating recurring vendor payments

ACH infrastructure is often preferred for predictable billing and cost efficiency.

Benefits of Dwola

Cost Efficiency

ACH payments typically involve lower fees than card transactions.

Direct Bank Transfers

Funds move directly between financial institutions without card network intermediaries.

Scalable API Architecture

The platform supports growing transaction volumes.

Enhanced Operational Transparency

Webhook alerts and transaction tracking improve visibility.

Dwola vs Card-Based Payments

| Feature | Dwola (ACH) | Card Processing |

|---|---|---|

| Payment Rail | ACH network | Card networks |

| Fees | Lower (typically) | Higher |

| Recurring Billing | Supported | Supported |

| Settlement Model | Bank transfer | Card authorization |

| Dispute Structure | ACH return | Card chargebacks |

ACH solutions are often selected for subscription services and marketplace payouts.

Compliance & Implementation Factors

Before integrating dwola infrastructure, organizations typically review:

- ACH network regulations

- Identity verification requirements

- Risk management policies

- Accounting system integration

- Customer onboarding processes

Dwolla provides structured tools to assist with compliance workflows.

Frequently Asked Questions

What does dwola refer to?

Dwola is commonly a misspelling of Dwolla, a U.S.-based ACH payment infrastructure provider.

Does Dwolla support card payments?

Dwolla focuses primarily on ACH bank transfers.

Is Dwolla suitable for recurring subscriptions?

Yes, recurring ACH billing is a common implementation scenario.

Can marketplaces use Dwolla?

Yes, marketplaces often use ACH transfers for settlements.

Conclusion

If you are searching for dwola, you are likely referring to Dwolla, a fintech company providing ACH payment automation. Its API-driven infrastructure allows businesses to integrate bank-to-bank transfers, automate recurring billing, and streamline marketplace settlements within the U.S. banking system.

For organizations seeking scalable ACH solutions, Dwolla offers structured integration, compliance support, and cost-efficient transaction processing.