Dwola: Complete Guide to ACH Payment Infrastructure & Bank Transfer Automation

Introduction

Many users search for dwola, but the correct company name is Dwolla. The term “dwola” is commonly used in search queries when looking for ACH payment solutions or bank-to-bank transfer platforms.

This guide explains what Dwolla does, how its ACH infrastructure works, and why businesses integrate it for scalable payment automation.

What Is Dwola (Dwolla)?

Dwolla is a U.S.-based fintech company that provides API-driven ACH payment solutions. Instead of focusing on consumer wallets, the platform enables businesses to embed bank transfer functionality directly into their own systems.

Dwola (Dwolla) is commonly used for:

- ACH bank transfers

- Recurring payments

- Marketplace settlements

- Account-to-account (A2A) transfers

- Payout automation

How Dwola ACH Payments Work

4

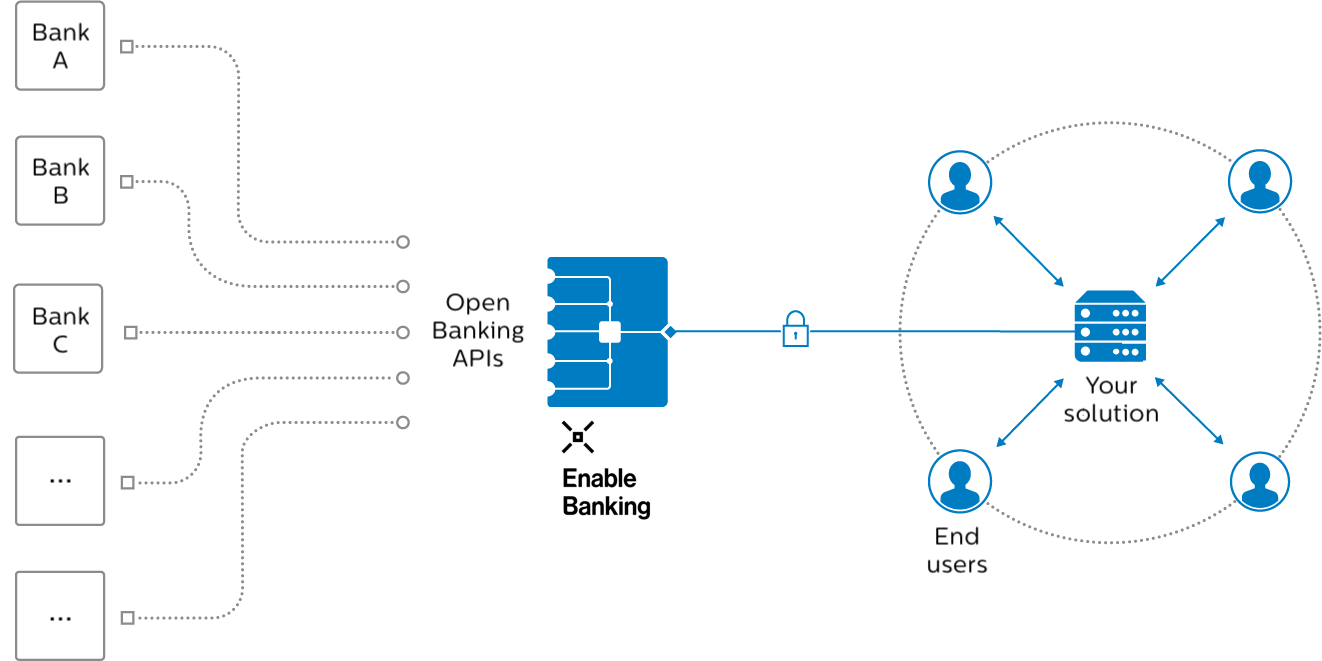

1. API Integration

Dwola provides developer-friendly APIs that allow businesses to:

- Create customer profiles

- Link bank accounts

- Initiate ACH transfers

- Monitor transaction status

- Receive webhook notifications

This allows payment functionality to be embedded directly into SaaS platforms, fintech apps, and marketplaces.

2. Bank Account Verification

The platform supports account verification workflows to confirm bank ownership and reduce fraud risk.

3. ACH Payment Processing

Funds are transferred through the U.S. ACH network, moving directly between bank accounts without relying on card networks.

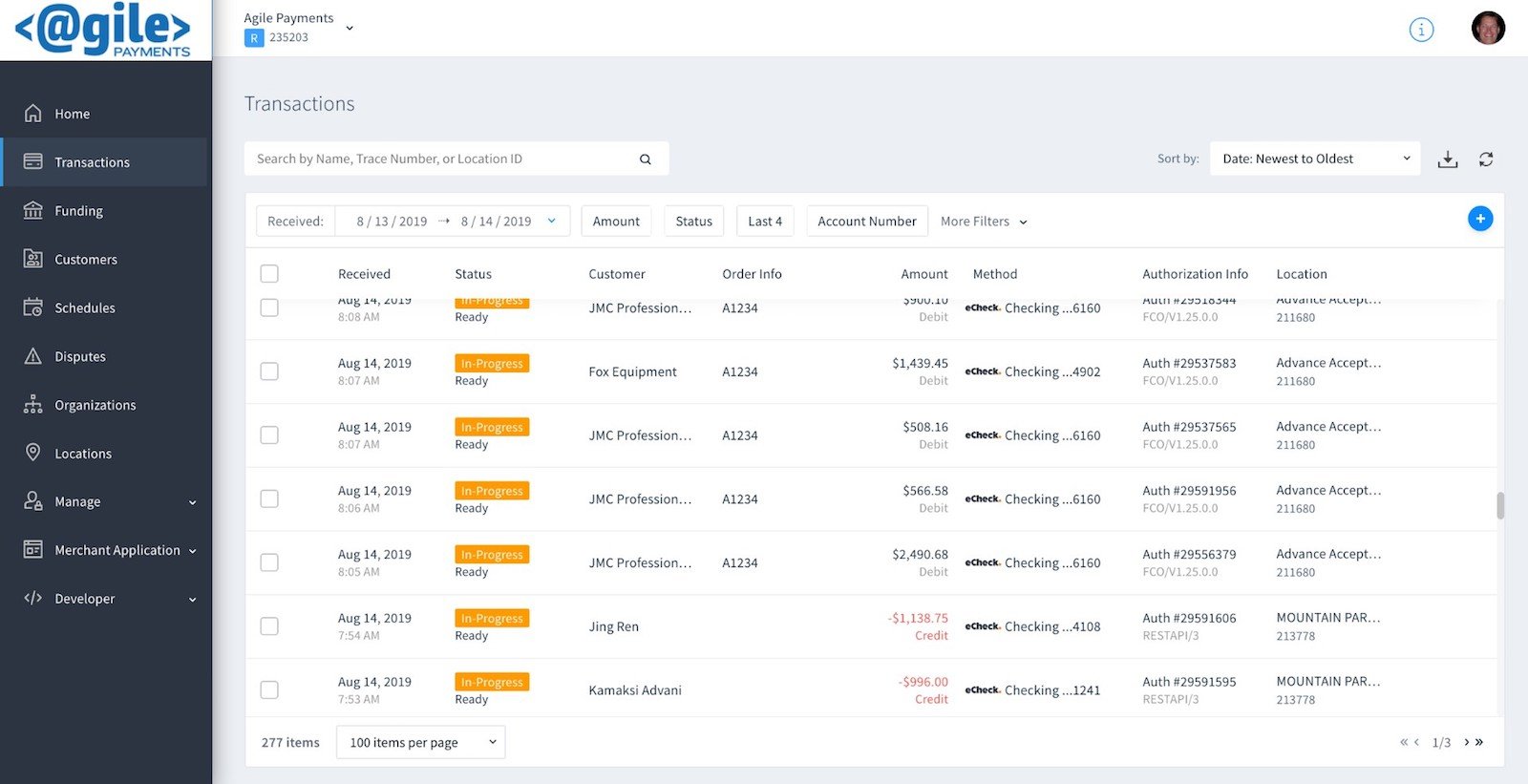

4. Reporting & Monitoring

Businesses can access:

- Transaction logs

- Payment status updates

- Automated notifications

- Exportable reports

These tools support reconciliation and internal accounting workflows.

Key Features of Dwola

ACH-Focused Infrastructure

Dwola specializes in bank-to-bank transfers via ACH rather than credit card processing.

API-First Architecture

Developers can fully integrate payment workflows into existing platforms.

Automation & Webhooks

Real-time notifications help synchronize financial systems.

Compliance & Risk Controls

The platform includes built-in identity verification and monitoring workflows.

Common Use Cases

4

Dwola is often used by:

- Online marketplaces

- SaaS subscription platforms

- Fintech applications

- Businesses requiring recurring ACH billing

- Platforms managing vendor or partner payouts

ACH solutions are frequently chosen for cost efficiency compared to card-based payments.

Advantages of Dwola

Lower Processing Costs

ACH transfers generally involve lower fees than credit card transactions.

Direct Bank Transfers

Payments move directly between financial institutions.

Embedded User Experience

Businesses maintain control of the payment interface inside their own applications.

Scalable Infrastructure

The system supports high transaction volumes.

Dwola vs Card Payment Processing

| Feature | Dwola (ACH) | Credit Card Processing |

|---|---|---|

| Payment Rail | ACH network | Card networks |

| Fees | Typically lower | Higher |

| Chargeback Model | ACH return process | Card chargebacks |

| API Integration | Yes | Yes |

| Recurring Billing | Supported | Supported |

ACH is often preferred for recurring billing or high-value transactions.

Frequently Asked Questions

What is dwola?

Dwola is a common misspelling of Dwolla, a fintech company providing ACH payment infrastructure.

Does Dwola support credit cards?

Dwolla primarily focuses on ACH bank transfers.

Can Dwola be used for marketplaces?

Yes, many marketplaces use ACH transfers for vendor settlements.

Is Dwola suitable for SaaS billing?

Yes, recurring ACH billing is a common use case.

Final Summary

If you are searching for dwola, you are likely looking for Dwolla, a U.S.-based ACH payment infrastructure provider. Its API-driven system allows businesses to embed bank-to-bank payment functionality, automate recurring billing, and manage marketplace settlements efficiently.

For companies seeking scalable ACH payment solutions within the U.S. banking system, Dwolla offers structured automation, compliance workflows, and developer-friendly integration.